Dollar Cost Averaging: A Smart Investment Strategy for Long-Term Success

Investing in volatile markets can be intimidating, especially for beginners. Dollar cost averaging (DCA) is a time-tested strategy that makes investing simpler, reduces risk, and helps you build wealth over time. By spreading out your investments over regular intervals, DCA removes the stress of market timing and allows you to benefit from price fluctuations. Whether you’re investing in stocks, mutual funds, or cryptocurrency, understanding dollar cost averaging can transform the way you manage your portfolio.

What is Dollar Cost Averaging?

Dollar cost averaging is a systematic investment approach where you invest a fixed amount of money at regular intervals, regardless of market conditions. This strategy ensures that you buy more units when prices are low and fewer units when prices are high. Over time, this helps reduce the average cost per unit, maximizing your returns in the long run. Dollar cost averaging is particularly effective in volatile markets, as it minimizes the impact of short-term price fluctuations.

Benefits of Dollar Cost Averaging

One of the main advantages of dollar cost averaging is its simplicity. It eliminates the need to time the market, a challenge even for seasoned investors. Additionally, dollar cost averaging helps reduce emotional decision-making, as it encourages consistent investment regardless of market sentiment. This approach also minimizes risk by spreading investments over time, which can be especially useful during periods of uncertainty. Furthermore, dollar cost averaging allows beginners to start investing with smaller amounts, making it accessible to a broader audience.

How to Implement Dollar Cost Averaging

To implement dollar cost averaging, start by selecting an investment vehicle, such as stocks, ETFs, or mutual funds. Next, determine the fixed amount you’re comfortable investing and the frequency of your investments—this could be weekly, monthly, or quarterly. Automating your investments through a brokerage account can simplify the process and ensure consistency. Remember to monitor your portfolio regularly and adjust your strategy as needed to align with your financial goals. Dollar cost averaging works best as part of a disciplined, long-term investment plan.

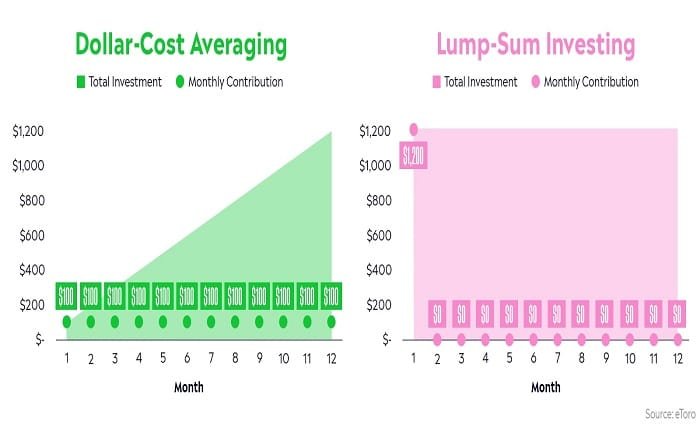

Dollar Cost Averaging vs. Lump-Sum Investing

While dollar cost averaging spreads investments over time, lump-sum investing involves putting a large amount of money into the market at once. Both strategies have their merits, but dollar cost averaging is particularly advantageous during volatile markets, as it reduces the risk of investing at a market peak. Lump-sum investing, on the other hand, may yield higher returns in a consistently rising market. The choice between the two strategies often depends on your risk tolerance, market outlook, and available capital. However, dollar cost averaging remains a safer and more consistent approach for many investors.

Real-Life Examples of Dollar Cost Averaging

Consider an investor who commits to investing $500 monthly in a mutual fund. In January, the fund’s price per unit is $25, allowing the investor to buy 20 units. By March, the price drops to $20, enabling the purchase of 25 units. In June, the price rises to $30, and the investor acquires 16.67 units. Over time, the average cost per unit is lower than the highest market price, showcasing the power of dollar cost averaging. This real-life example highlights how this strategy benefits investors in fluctuating markets.

Common Mistakes to Avoid in Dollar Cost Averaging

While dollar cost averaging is a simple and effective strategy, it’s not foolproof. One common mistake is neglecting to stay consistent with investments. Skipping investments during market downturns can reduce the strategy’s effectiveness. Another error is failing to diversify your portfolio, which increases risk exposure. Additionally, some investors mistakenly use dollar cost averaging for short-term gains instead of long-term wealth building. Understanding these pitfalls ensures you get the most out of your dollar cost averaging strategy.

Conclusion

Dollar cost averaging is a powerful investment strategy that simplifies investing, reduces risks, and capitalizes on market volatility. By committing to regular investments, you can steadily build wealth over time without the stress of market timing. Whether you’re a beginner or a seasoned investor, incorporating dollar cost averaging into your financial plan can enhance your investment journey and help you achieve your goals.

FAQs

- What is dollar cost averaging?

Dollar cost averaging is an investment strategy where you invest a fixed amount regularly, regardless of market conditions, to reduce risk. - Why is dollar cost averaging effective?

It minimizes emotional decision-making, reduces the impact of market volatility, and helps lower the average cost per unit over time. - Can I use dollar cost averaging with cryptocurrency?

Yes, dollar cost averaging works well with volatile assets like cryptocurrency, allowing you to buy more when prices are low. - How does dollar cost averaging compare to lump-sum investing?

Dollar cost averaging reduces risk in volatile markets, while lump-sum investing may yield higher returns in steadily rising markets. - Is dollar cost averaging suitable for everyone?

Dollar cost averaging is ideal for long-term investors with a steady income who want to invest consistently without timing the market.