How to Invest Money to Make Money: A Comprehensive Guide

Introduction

Investing money wisely is one of the most effective ways to build wealth over time. Whether you’re a novice or an experienced investor, understanding the different investment options and strategies can help you make more informed decisions and increase your chances of achieving financial success. This guide will cover everything from the basics of investing to advanced strategies, ensuring you have the knowledge you need to make your money work for you.

The Basics of Investing

What is Investing?

Investing involves allocating your money to various financial instruments or assets with the expectation of generating income or profit. The primary goal is to grow your wealth over time through capital appreciation, dividends, or interest.

Importance of Investing

Investing is crucial for several reasons:

- Inflation Hedge: Investing helps protect your money from inflation, which erodes purchasing power over time.

- Wealth Building: Through compounding returns, investing allows your money to grow exponentially.

- Achieving Financial Goals: Investing can help you achieve long-term financial goals, such as retirement, buying a home, or funding education.

Setting Investment Goals

Short-Term vs. Long-Term Goals

Identifying your investment goals is the first step in creating an investment plan. Goals can be categorized as short-term (e.g., saving for a vacation) or long-term (e.g., retirement).

Risk Tolerance

Your risk tolerance is crucial. It determines the types of investments suitable for you. Higher risk typically equates to higher potential returns but also higher potential losses.

Types of Investment Vehicles

Stocks

Stocks represent ownership in a company. They offer high potential returns but come with higher risk.

Bonds

Bonds are debt securities issued by governments or corporations. They provide regular interest payments and are generally less risky than stocks.

Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets.

ETFs

Exchange-Traded Funds (ETFs) are similar to mutual funds but trade on stock exchanges. They offer diversification and are typically more cost-effective.

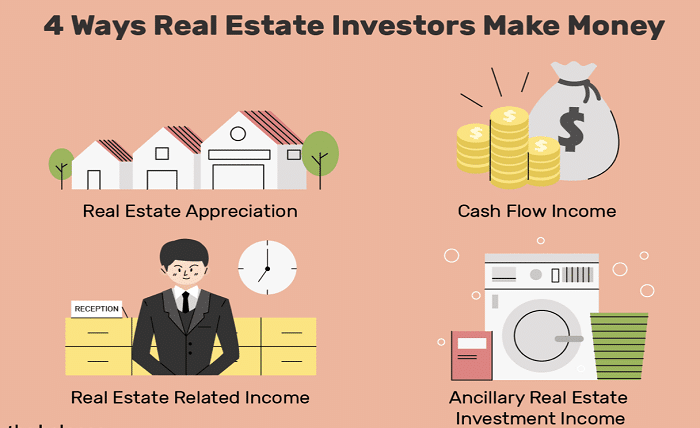

Real Estate

Investing in real estate involves purchasing property to generate rental income or capital appreciation. It can be a stable and lucrative investment.

Cryptocurrencies

Cryptocurrencies are digital assets that use blockchain technology. They are highly volatile but offer significant growth potential.

Building a Diversified Portfolio

Why Diversification Matters

Diversification reduces risk by spreading investments across various asset classes. It ensures that the performance of one investment doesn’t heavily impact your overall portfolio.

How to Diversify

Invest in a mix of asset classes (stocks, bonds, real estate) and sectors (technology, healthcare, finance) to achieve diversification.

Investment Strategies

Dollar-Cost Averaging

Investing a fixed amount regularly, regardless of market conditions, helps reduce the impact of market volatility.

Value Investing

Value investing involves buying undervalued stocks with strong fundamentals. It requires thorough research and patience.

Growth Investing

Growth investors focus on companies with high growth potential. These stocks may have higher valuations but offer significant upside.

Income Investing

Income investing focuses on assets that generate regular income, such as dividends from stocks or interest from bonds.

Market Cycles

Bull Markets

A bull market is characterized by rising prices and investor optimism. It’s a good time to invest in growth-oriented assets.

Bear Markets

A bear market features declining prices and investor pessimism. It presents opportunities to buy quality assets at lower prices.

The Role of Financial Advisors

When to Consult a Financial Advisor

Financial advisors can provide valuable insights and guidance, especially if you’re new to investing or have complex financial situations.

Choosing the Right Advisor

Look for certified advisors with a fiduciary duty to act in your best interest. Check their track record and fees before making a decision.

Investing in Retirement Accounts

401(k) Plans

Employer-sponsored 401(k) plans offer tax advantages and often include employer matching contributions.

IRAs

Individual Retirement Accounts (IRAs) provide tax benefits and a wide range of investment options.

Managing Investment Risks

Understanding Different Types of Risk

Investment risks include market risk, credit risk, interest rate risk, and inflation risk. Understanding these can help you mitigate potential losses.

Risk Management Techniques

Diversification, asset allocation, and regular portfolio reviews are essential risk management techniques.

Staying Informed and Updated

Following Market News

Staying updated with financial news and market trends helps you make informed investment decisions.

Continuous Learning

Investing is a continuous learning process. Reading books, taking courses, and following expert advice can enhance your investing skills.

Conclusion

Investing money to make money is a journey that requires knowledge, patience, and discipline. By understanding the basics, setting clear goals, diversifying your portfolio, and staying informed, you can navigate the world of investing with confidence. Remember, there are no guarantees in investing, but with a well-thought-out strategy and a commitment to continuous learning, you can significantly improve your chances of financial success.

FAQs

- What is the best investment for beginners?

- The best investment for beginners is typically a diversified portfolio of low-cost index funds or ETFs. These provide exposure to a broad range of assets and reduce risk.

- How much should I invest initially?

- The amount you should invest initially depends on your financial situation and goals. It’s advisable to start with an amount you can afford to lose and gradually increase your investments as you gain confidence and knowledge.

- How often should I review my investment portfolio?

- It’s recommended to review your investment portfolio at least once a year or when significant life events occur. Regular reviews help ensure your investments align with your goals and risk tolerance.

- Is it better to invest in individual stocks or mutual funds?

- Investing in individual stocks can offer higher returns but comes with higher risk and requires more research. Mutual funds provide diversification and professional management, making them a safer choice for many investors.

- Can I invest with little money?

- Yes, you can start investing with little money. Many online platforms and robo-advisors offer low minimum investment requirements, allowing you to begin with small amounts and grow your portfolio over time.