Max Pain Finnifty is a pivotal concept in options trading that helps traders understand market dynamics. Rooted in the Max Pain Theory, it suggests that the price point where the most options (both calls and puts) expire worthless is the “max pain” point for option holders. For Finnifty, which refers to the Nifty 50 index in India, this theory provides insights into potential price movements as the options expiration date approaches. By analyzing Max Pain Finnifty, traders can anticipate where the market might gravitate to minimize the losses of option writers. This understanding allows for more informed decision-making, whether you’re buying or selling options. Incorporating Max Pain Finnifty into your trading strategy can enhance your ability to predict market behavior, making it a valuable tool for both novice and experienced traders.

Introduction to Nifty 50 Index

The Nifty 50 index, often referred to as Finnifty, is one of the most prominent stock indices in India. It represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange (NSE). Understanding Finnifty is crucial for investors and traders as it serves as a benchmark for the Indian equity market’s performance. Max Pain Finnifty specifically focuses on the options market related to this index, providing a deeper layer of analysis for those involved in derivatives trading. By monitoring Finnifty, traders can gain insights into market trends, volatility, and potential turning points. This makes Finnifty not just a reflection of market health but also a tool for strategic trading decisions, especially when combined with Max Pain Theory.

What is Max Pain Finnifty?

finnifty refers to the specific strike price in the Nifty 50 options market where the highest number of options contracts (both calls and puts) will expire worthless. This concept is derived from the broader Max Pain Theory, which posits that market makers and option writers manipulate prices to minimize their payouts. For Finnifty traders, identifying the Max Pain point can provide a strategic advantage. By knowing where the market is likely to settle at expiration, traders can make more informed decisions about their option positions. This anticipation helps in reducing potential losses and optimizing profits. Max Pain Finnifty serves as a predictive tool, aligning traders’ strategies with the underlying forces shaping market movements.

How to Calculate Max Pain for Nifty 50

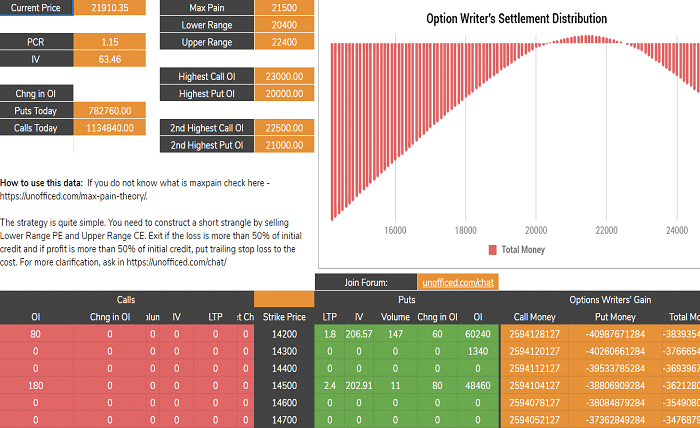

Calculating Max Pain Finnifty involves analyzing the open interest of all outstanding call and put options for the Nifty 50 index. The process begins by listing all strike prices and tallying the number of call and put contracts at each level. For each strike price, you calculate the total payout if the index settles at that price by determining the number of options that would expire worthless. The strike price with the lowest total payout across all options is identified as the Max Pain point. This calculation requires access to up-to-date options data, which can be sourced from financial platforms or the NSE website. By accurately calculating Max Pain Finnifty, traders can better anticipate market movements and adjust their strategies accordingly, enhancing their overall trading performance.

Importance of Max Pain Finnifty in Trading Strategies

Incorporating Max Pain Finnifty into your trading strategy offers several advantages. Firstly, it provides a clear indicator of potential price levels where the market might stabilize, helping traders make more informed entry and exit decisions. Understanding the Max Pain point can also aid in managing risk, as it highlights areas where options are likely to expire worthless, minimizing unexpected losses. Additionally, Max Pain Finnifty can enhance the timing of trades, allowing traders to capitalize on anticipated price movements around options expiration dates. By aligning your strategy with the Max Pain theory, you can leverage market mechanics to your advantage, making your trading approach more robust and data-driven.

Analyzing Historical Max Pain Levels in Finnifty

Examining historical Max Pain Finnifty levels can provide valuable insights into recurring market patterns and behaviors. By analyzing past data, traders can identify how often the Nifty 50 index gravitates towards the Max Pain point at expiration. This historical perspective helps in validating the effectiveness of the Max Pain Theory in predicting market movements. Additionally, understanding the frequency and consistency of Max Pain occurrences in Finnifty can enhance the reliability of this indicator in future trading scenarios. Historical analysis also allows traders to refine their strategies, adjusting for anomalies and improving their predictive accuracy based on observed trends and patterns.

Max Pain Finnifty and Market Sentiment

Max Pain Finnifty is closely intertwined with overall market sentiment. Market sentiment, which reflects the collective mood of investors, can influence how the Nifty 50 index moves towards the Max Pain point. When bullish sentiment prevails, the index might resist moving towards the Max Pain level, while bearish sentiment might accelerate this movement. Understanding the relationship between Max Pain Finnifty and market sentiment enables traders to gauge the underlying forces driving price movements. By combining sentiment analysis with Max Pain data, traders can develop a more comprehensive view of the market, enhancing their ability to anticipate and respond to shifts in investor behavior.

Tools and Resources for Tracking Max Pain Finnifty

Several tools and resources are available to help traders track and analyze Max Pain Finnifty. Financial platforms like NSE’s official website provide real-time options data essential for calculating Max Pain. Additionally, specialized software and online calculators can automate the Max Pain calculation process, saving time and reducing errors. Trading platforms often integrate Max Pain indicators, offering visual representations and alerts to keep traders informed. Educational resources, including tutorials and webinars, can further enhance a trader’s understanding of Max Pain Finnifty and its applications. Leveraging these tools and resources ensures that traders have the necessary information and support to effectively incorporate Max Pain Finnifty into their trading strategies.

Limitations of Max Pain Finnifty Theory

While Max Pain Finnifty is a valuable tool, it is not without limitations. The theory assumes that market makers will always act to drive the index towards the Max Pain point, which may not hold true in all market conditions. External factors such as macroeconomic events, geopolitical developments, and unexpected market news can influence the Nifty 50 index, overriding the Max Pain effect. Additionally, the accuracy of Max Pain Finnifty depends on the availability and reliability of options data, which can sometimes be delayed or incomplete. Traders should use Max Pain Finnifty as one of several indicators in their analysis, rather than relying on it exclusively. Acknowledging these limitations ensures a balanced and informed approach to utilizing Max Pain Finnifty in trading decisions.

Integrating Max Pain Finnifty into Your Trading Plan

To effectively integrate Max Pain Finnifty into your trading plan, start by incorporating it into your regular market analysis routine. Use Max Pain data to identify potential support and resistance levels around options expiration dates. Align your entry and exit points with the anticipated price movements towards the Max Pain point to optimize your trades. Additionally, combine Max Pain Finnifty with other technical indicators and fundamental analysis to create a comprehensive trading strategy. Regularly reviewing and adjusting your approach based on Max Pain insights can enhance your ability to navigate the complexities of the options market. By thoughtfully integrating Max Pain Finnifty, you can improve your decision-making process and increase the potential for profitable trades.

Practical Examples of Max Pain Finnifty in Action

Understanding Max Pain Finnifty becomes clearer through practical examples. Consider a scenario where the Nifty 50 index is approaching an options expiration date, and the Max Pain point is identified at 18,500. If the current index level is 18,700, traders might anticipate a downward movement towards 18,500 as expiration approaches. By positioning their trades accordingly—such as selling calls or buying puts near the Max Pain strike—traders can capitalize on the expected price movement. Another example involves monitoring changes in open interest across different strike prices; a significant shift towards a new Max Pain level can signal upcoming volatility. These practical applications demonstrate how Max Pain Finnifty can guide trading decisions and enhance market strategies.

Conclusion

Incorporating Max Pain Finnifty into your trading strategy offers a strategic advantage by providing insights into potential market movements based on options data. Understanding how the Nifty 50 index interacts with the Max Pain theory allows traders to make informed decisions, manage risks effectively, and optimize their trading outcomes. While Max Pain Finnifty is a powerful tool, it should be used in conjunction with other indicators and analyses to ensure a well-rounded approach. By leveraging the principles of Max Pain Finnifty, traders can navigate the complexities of the options market with greater confidence and precision, ultimately enhancing their overall trading performance.

FAQs

Q1. What is Max Pain Finnifty?

A1. Max Pain Finnifty refers to the strike price in Nifty 50 options where the highest number of options contracts will expire worthless, minimizing payouts for option writers.

Q2. How is Max Pain Finnifty calculated?

A2. It is calculated by analyzing the open interest of all call and put options for each strike price of the Nifty 50 index and identifying the price point with the lowest total payout.

Q3. Can Max Pain Finnifty predict market movements accurately?

A3. While Max Pain Finnifty provides valuable insights, it should be used alongside other indicators as it is not foolproof and can be influenced by external market factors.

Q4. Is Max Pain Finnifty suitable for beginner traders?

A4. Yes, Max Pain Finnifty can be beneficial for traders at all levels, but beginners should complement it with other learning resources and trading strategies.

Q5. What tools can help track Max Pain Finnifty?

A5. Financial platforms like the NSE website, specialized Max Pain calculators, and trading software with integrated Max Pain indicators are useful for tracking Max Pain Finnifty.