Introduction

Navigating the world of stocks can be as exciting as it is daunting, particularly for those new to investing. With a vast array of options, from blue-chip stalwarts to innovative tech startups, understanding where to invest your hard-earned money is crucial for building a robust financial future. This comprehensive guide delves into the top stocks across various sectors that are poised for growth in the current economic climate, helping you make informed decisions tailored to your financial goals.

The Stock Market Basics

Before diving into specific stocks, it’s essential to grasp basic stock market concepts, including stock types, market trends, and risk assessment. This foundation will help you understand the reasoning behind stock recommendations and market movements.

Criteria for Choosing Investment Stocks

Learn about the key factors to consider when selecting stocks, such as the company’s financial health, growth potential, market position, and economic impact. These criteria will aid in filtering out the best options for your investment portfolio.

Best Stocks for Long-Term Investments

Explore a curated list of stocks that have demonstrated consistent growth and stability, making them ideal for long-term investment strategies. This section will highlight industries and companies that are expected to thrive over time.

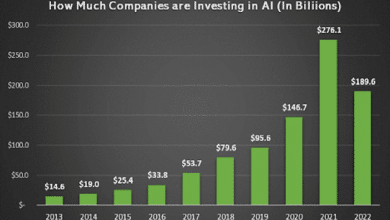

Top Tech Stocks to Watch

The technology sector remains a hotbed for growth. This segment will focus on tech companies that are innovating and expanding, from AI and cloud computing to renewable energy solutions.

Healthcare Stocks with Potential

With an aging population and advancing medical technologies, healthcare stocks are increasingly attractive. This section will outline promising companies in biotech, pharmaceuticals, and healthcare services.

Emerging Markets and Stock Opportunities

Emerging markets offer unique growth opportunities. Here, we’ll discuss which regions and sectors are ripe for investment and the stocks that are leading the charge.

Energy Sector: Renewables and Traditional Picks

The energy sector is in transition, presenting opportunities in both renewable sources and traditional energy. Discover which companies are well-positioned to capitalize on these trends.

Financial Sector Stocks That Promise Growth

The financial sector can offer stable returns. This part will review the top banks, investment firms, and insurance companies that are expected to perform well in the coming years.

Consumer Goods Stocks to Consider

This section will dive into consumer goods, a sector that can reflect the overall economic health. We’ll highlight companies that show resilience and growth potential in various economic conditions.

Real Estate Investment Trusts (REITs)

REITs offer an alternative to direct real estate investments and can provide steady income through dividends. Learn about the types of REITs and which are currently offering the best returns.

How to Diversify Your Investment Portfolio

Diversification is key to managing risk. This section will guide you on how to balance your portfolio across different sectors and asset types to protect against market volatility.

Conclusion

Choosing the right stocks to invest in is a blend of art and science — requiring a mix of market knowledge, foresight, and risk tolerance. By staying informed and considering a diversified portfolio, you can position yourself for success in the investment world. Remember, every investment carries risk, and it’s important to do your own research or consult with a financial advisor to tailor your investment choices to your personal financial situation.

FAQs

1. What factors should I consider before investing in a stock? Before investing, consider the company’s financial health, market position, growth potential, and the economic environment.

2. How often should I review my stock investments? Review your portfolio at least annually, or whenever there are significant changes in the market or your financial goals.

3. Can investing in stocks help me retire early? Strategic stock investments can grow your wealth and potentially expedite your retirement, depending on your investment choices and market performance.

4. What is the best way to manage risk in stock investments? Diversifying your portfolio across various sectors and investment types is a key strategy for managing risk.

5. Are tech stocks still a good investment? Tech stocks, particularly those with solid fundamentals and innovative capabilities, continue to offer significant growth opportunities, though they may also carry higher volatility.