Mutual Funds: How They Work, Types, and Benefits

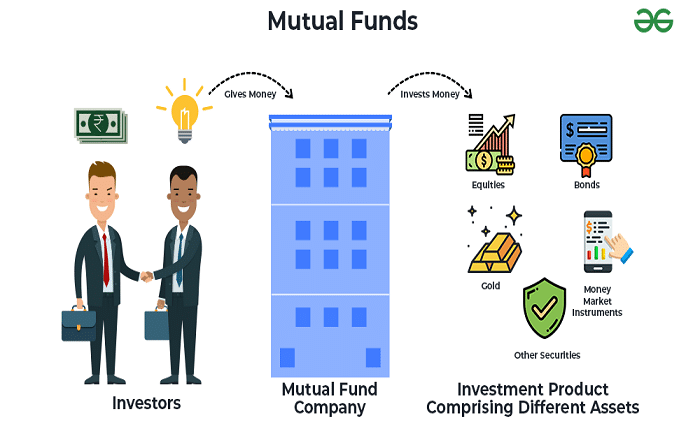

Mutual funds are popular investment vehicles that pool money from multiple investors to invest in securities like stocks, bonds, and other assets. The fund is managed by professional portfolio managers who allocate the funds to achieve specific financial objectives, such as growth or income. Mutual funds provide an easy and accessible way for individuals to diversify their investments without having to manage individual stocks or bonds directly.

Investing in mutual funds is ideal for those who are looking for a balanced approach to wealth growth while avoiding the complexities of directly handling different types of securities. They are designed for investors who prefer a hands-off approach to investing, making them an attractive option for beginners and seasoned investors alike. In this post, we will dive into the fundamentals of mutual funds, how they work, and what makes them an essential part of any investment strategy.

How Do Mutual Funds Work?

The process of investing in mutual funds begins with investors pooling their money together. This capital is then used by a professional portfolio manager to purchase various assets that match the fund’s objective, such as growth, income, or stability. The mutual fund then issues units or shares to investors, representing their proportional ownership in the fund.

Mutual funds are structured to allow diversification and reduce risk. By spreading investments across multiple securities, the impact of any single investment performing poorly is minimized. The profits or losses of the fund are distributed among the investors in proportion to their ownership.

Investors in mutual funds benefit from the expertise of the fund manager, who makes decisions on buying, holding, or selling securities to maximize returns. Fees and expenses are typically charged for this management, which can include expense ratios and other administrative costs. These fees vary depending on the type of fund and the management company.

Types of Mutual Funds

Mutual funds come in various forms, each with its own specific purpose and characteristics. The most common types of mutual funds are equity funds, bond funds, balanced funds, money market funds, and index funds.

- Equity Funds invest primarily in stocks, aiming for capital growth. These funds are riskier but provide potentially high returns.

- Bond Funds invest in bonds and other debt securities, aiming for regular income. They are less risky compared to equity funds.

- Balanced Funds combine stocks and bonds to provide a mix of growth and income, offering a moderate risk level.

- Money Market Funds invest in short-term securities, providing stability and liquidity with lower returns.

- Index Funds track a particular index, like the S&P 500, offering lower fees and passive management.

By selecting a type of mutual fund that matches your financial goals and risk tolerance, you can ensure that your investments align with your long-term objectives.

Benefits of Investing in Mutual Funds

Mutual funds offer numerous benefits to investors, which is why they are popular among different types of investors. One major advantage of mutual funds is diversification. Investing in a wide variety of securities reduces the risk associated with putting all your money in a single investment.

Another key benefit is professional management. The fund managers have expertise in analyzing markets, selecting securities, and managing portfolios. This means that even if you lack the time or expertise to manage investments, you can still participate in the growth of the financial markets through mutual funds.

Moreover, mutual funds are highly liquid, meaning you can easily buy or sell your shares without facing significant delays or high transaction costs. This liquidity is particularly important when you need access to your investment quickly.

Costs Involved in Mutual Fund Investing

While mutual funds provide many benefits, there are costs involved that you need to understand before investing. The most common expenses are the expense ratio, load fees, and management fees.

The expense ratio covers the annual fees associated with operating the mutual fund. It includes administrative fees, operating costs, and management fees. A high expense ratio can affect your overall returns, so it is important to choose a mutual fund with a reasonable fee structure.

Load fees are sales commissions that are either charged when you buy (front-end load) or when you sell (back-end load) the mutual fund. There are also no-load funds, which do not charge these fees, making them a preferred option for many investors.

Management fees are paid to the professional managers overseeing the fund, which can impact your net return. Understanding these costs helps you determine which mutual funds align with your financial goals.

Risks of Investing in Mutual Funds

As with any investment, mutual funds come with their own risks. The value of a mutual fund depends on the market value of the securities within the fund, which means their value can fluctuate based on market conditions.

Market risk is one of the most significant risks associated with mutual funds. If the financial markets experience a downturn, the value of the investments in the fund can decrease, affecting the overall value of the mutual fund.

Another risk is interest rate risk, which impacts bond funds. When interest rates rise, the value of bonds tends to fall, which can lead to a decline in the fund’s value. Additionally, mutual funds are subject to liquidity risk, where the fund may struggle to sell certain assets in adverse market conditions.

It is crucial to consider your risk tolerance before investing in mutual funds and choose funds that align with your financial goals and risk appetite.

How to Choose the Right Mutual Fund

Choosing the right mutual fund depends on your investment objectives, time horizon, and risk tolerance. The first step is to define your goals: are you looking for growth, income, or capital preservation? Different mutual funds cater to these varying goals.

Another important factor is understanding your risk tolerance. If you are willing to take on more risk for potentially higher returns, equity funds might be suitable. On the other hand, if stability is more important, bond or money market funds could be better options.

You should also look at the mutual fund’s past performance, expense ratio, and the reputation of the fund manager. While past performance does not guarantee future success, it can give you an idea of how well the fund has been managed in different market conditions.

Tax Implications of Mutual Funds

When investing in mutual funds, it is essential to be aware of the tax implications. Mutual fund investments can lead to capital gains taxes if the fund sells assets at a profit. Additionally, dividends earned from the mutual fund are also taxable.

Equity mutual funds are subject to different tax rates compared to debt funds. The tax rate on equity mutual funds is lower if you hold the investment for more than one year, which is known as long-term capital gains. However, if you sell within one year, it is subject to short-term capital gains tax, which is higher.

To minimize tax liabilities, it is advisable to hold mutual fund investments for the long term, take advantage of tax-efficient funds, and consult with a tax advisor for guidance.

How to Invest in Mutual Funds

Investing in mutual funds has become more accessible than ever, thanks to online platforms and robo-advisors. You can invest through your broker, financial advisor, or directly with a mutual fund company.

The first step is to open an investment account. Most investment platforms provide an easy-to-use interface that allows you to search and choose mutual funds that match your goals. Many platforms allow you to invest in mutual funds with minimal initial investments, which makes it accessible to everyone.

You can also set up a Systematic Investment Plan (SIP), where a fixed amount is invested at regular intervals. SIPs are a popular way to invest consistently over time, allowing investors to take advantage of rupee cost averaging and reduce the impact of market volatility.

Mutual Funds vs. ETFs: What’s the Difference?

Both mutual funds and Exchange-Traded Funds (ETFs) are popular investment vehicles that allow for diversification, but there are some key differences. Mutual funds are actively managed, meaning a portfolio manager selects the securities, while ETFs are usually passively managed and aim to track an index.

Liquidity is another significant difference. ETFs can be traded throughout the trading day, while mutual fund transactions are processed at the end of the trading day. Additionally, ETFs tend to have lower expense ratios compared to actively managed mutual funds, making them more cost-effective for investors who prefer a passive approach.

Understanding these differences can help you decide which option best suits your investment strategy and goals.

Conclusion

Mutual funds are an excellent choice for investors looking to diversify their portfolios, benefit from professional management, and participate in the financial markets without directly handling individual securities. They offer different types of funds to match your risk tolerance, investment goals, and time horizon.

Although there are risks and costs associated with mutual funds, with careful selection and a clear understanding of your objectives, mutual funds can be a powerful tool in achieving your financial goals.

FAQs

- What is a mutual fund? A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities.

- How do mutual funds make money? Mutual funds make money through dividends, interest, and capital gains from the securities held in the portfolio.

- Are mutual funds safe investments? While mutual funds are diversified, they are not without risk. The level of safety depends on the type of fund and market conditions.

- What is the minimum amount to invest in a mutual fund? The minimum amount varies but can be as low as $500, and some platforms allow investments with even smaller amounts through SIPs.

- How are mutual funds taxed? Mutual funds are subject to capital gains taxes when sold at a profit, and dividends may also be taxed, depending on the investor’s tax bracket.