Navigating the Best Index Funds to Invest in: Top Picks for Diverse Portfolios

Introduction

Investing in index funds has become a cornerstone strategy for both novice and seasoned investors aiming to build wealth over the long term. Index funds provide a straightforward, cost-effective way to gain exposure to a broad segment of the market. This blog post delves into the best index funds to invest in, offering insights into their performance, cost efficiency, and suitability for various investment goals.

Index Funds

Index funds are investment vehicles that replicate the performance of a specific index, like the S&P 500 or the NASDAQ. By investing in these funds, you’re buying into a broad, diverse portfolio of stocks or bonds, mirroring the index’s movements. This section will explore why index funds have become such a popular choice among investors.

Benefits of Index Fund Investing

One of the major draws of index funds is their low cost. Unlike actively managed funds, index funds boast lower expense ratios because they require less management oversight. Additionally, index funds are known for their transparency and diversification, which can help mitigate risk.

Top Index Funds for Large Cap Exposure

For those looking to invest in large-cap stocks, certain index funds stand out. The Vanguard 500 Index Fund (VFIAX) and the Schwab S&P 500 Index Fund (SWPPX) are excellent examples, both offering robust performance histories and low expense ratios.

Best Index Funds for Small to Mid Cap Stocks

Investing in smaller companies can offer higher growth potential. Index funds like the Vanguard Mid-Cap Index Fund (VIMAX) and the iShares Russell 2000 ETF (IWM) provide effective ways to gain this exposure.

Leading International Index Funds

For investors aiming to diversify internationally, there are several great index funds. The Vanguard Total International Stock Index Fund (VTIAX) and the Fidelity International Index Fund (FSPSX) offer comprehensive exposure to global markets outside of the United States.

Sector-Specific Index Funds

Sector-specific index funds allow investors to target specific industries. Whether it’s technology, healthcare, or finance, funds like the Technology Select Sector SPDR Fund (XLK) can provide targeted exposure to sectors with growth potential.

Bond Index Funds for Stable Returns

For those seeking stability, bond index funds like the Vanguard Total Bond Market Index Fund (VBTLX) and the iShares Core U.S. Aggregate Bond ETF (AGG) offer safe investment avenues, providing regular income through dividends.

Index Funds with ESG Focus

Investors increasingly prefer funds that consider environmental, social, and governance (ESG) criteria. The iShares ESG MSCI U.S.A. Leaders ETF (SUSL) and the Vanguard ESG U.S. Stock ETF (ESGV) are leading choices in this category.

Strategies for Investing in Index Funds

Investing in index funds isn’t just about picking the right fund; it’s also about how you incorporate these funds into your overall investment strategy. This section covers dollar-cost averaging, balancing, and other strategies to maximize your index fund investments.

Comparing Index Funds and Mutual Funds

While index funds are a type of mutual fund, they differ significantly from traditional mutual funds, which are actively managed. Understanding these differences is crucial for making informed investment decisions.

Conclusion

The best index funds to invest in offer a blend of affordability, transparency, and diversification. Whether you’re looking to invest in broad market indices, specific sectors, or international markets, there’s an index fund that suits your investment goals. By carefully selecting and strategically investing in these index funds, you can build a robust, resilient investment portfolio poised for long-term growth.

FAQs

Q1: What are index funds? A1: Index funds are mutual funds or ETFs that replicate the performance of a predefined index, providing investors with a passive investment strategy aimed at mirroring the index’s returns.

Q2: Why are index funds considered a good investment? A2: Index funds are favored for their low cost, simplicity, and diversification, making them a solid investment choice for achieving long-term financial goals.

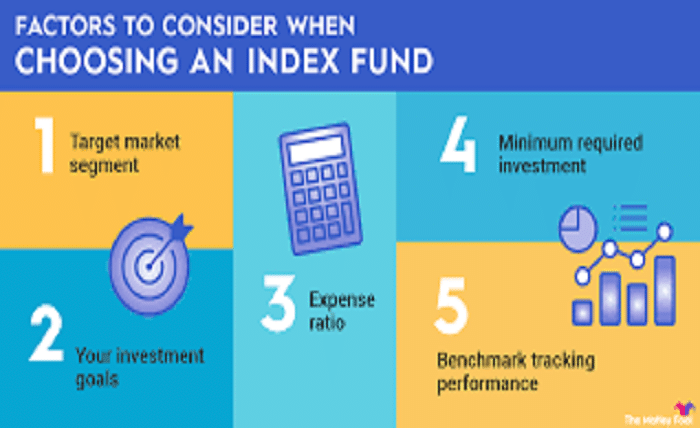

Q3: How do I choose the best index fund to invest in? A3: When selecting the best index funds, consider factors such as the fund’s expense ratio, performance history, and whether it aligns with your investment objectives and risk tolerance.

Q4: Can investing in index funds reduce investment risk? A4: Yes, by diversifying across a wide range of assets, index funds can help reduce unsystematic risk, making them a safer investment compared to individual stocks.

Q5: Are there any risks associated with index fund investing? A5: While index funds reduce certain risks, they are still subject to market risk, meaning the value of the investment can fluctuate with the market.